It’s pretty clear that the automotive industry in Europe is in trouble and has been so for the last couple of years. In fact, the European auto market is set to drop this year to the lowest volume of new car sales since 1995 with a -7.6% decline in eleven months of 2012 compared to the year before. Even in 1990, just as the Berlin Wall was being dismantled and the Cold War era came to an end, more new cars were sold in Europe than in 2012 as proven by the graph below based on data from the European Automotive Manufacturers’ Association (ACEA).

It’s pretty clear that the automotive industry in Europe is in trouble and has been so for the last couple of years. In fact, the European auto market is set to drop this year to the lowest volume of new car sales since 1995 with a -7.6% decline in eleven months of 2012 compared to the year before. Even in 1990, just as the Berlin Wall was being dismantled and the Cold War era came to an end, more new cars were sold in Europe than in 2012 as proven by the graph below based on data from the European Automotive Manufacturers’ Association (ACEA).

For 2013 Moody’s Investors Service predicts a continued weakening of the market with a forecast of a further -3% decline, meaning new car sales will have dropped more than -25% since the all-time high in 2007. Is this a temporary setback caused by the credit crunch and the banking collapse of 2008, or could it be more deeply rooted than that?

Let’s look at some more statistics. First of all, people in the so called ”rich world” have been driving less and less since the early 1990’s as explained by The Economist in a September 2012 article. To take a few examples, the pattern is clear in the UK, France and Germany and was so even before the crisis of 2008. Even in the car-crazy US, average kilometres travelled per car has dropped since 2005.

Then there is a second trend, also highlighted in the very same article, and that is the fact that young people are less and less interested in getting a driver’s license. In Germany, the share of young households without cars increased from 20% to 28% between 1998 and 2008, and in Sweden it was recently highlighted in an article that 60% of today’s 18-24 year olds in Stockholm do not have a driver’s license. With regards to the US, this article highlights that in 1983, 69% of all 17-year-olds had a driver’s license, but by 2008 that share had dropped to 50%.

How come we’re seeing this trend of less driving and less interest in getting licenses? Is it the economy? The Economist and a number of other articles published this year (such as this one from Time Magazine) all claim a combination of things, the economy being one of the reasons, but not necessarily the primary one. To take a few examples;

- More and more people are working from home part of their time because of online, thus reducing commuting. In the US, more than 34 million people work from home occasionally and 83% of employees work remotely at least part of the day.

- Young people are increasing their use of public transportation. According to The Economist, 16- to 34-year-olds in American households with incomes over $70,000 increased their public-transport use by 100% from 2001 to 2009.

- E-commerce is booming, not just traditional retail but also services like Spotify for music and Netflix for movies. In Sweden e-commerc increased 10.6% in 2011 to reach 5% of total retail sales. In the 3rd quarter of 2012 growth was 14% and for the Holiday season one third of the Swedish population say they will buy Christmas gifts online.

- In Britain trips to shops have been the category of car use that has dropped off most steeply since 1995, according to The Economist. Meanwhile car ownership and usage in city areas is decreasing. The Economist points out that in London car ownership has been falling since 1990, and the percentage of households without cars has been growing since 1992. In other British cities the proportion of carless households has been growing since 2005, also that well before the financial crisis of 2008.

- Improvements to public transportation and congestion taxes in cities like London and Stockholm further reduce the willingness to drive and own cars in cities, and as a response the popularity of online based car sharing services are on the rise.

- Online in general, and especially among young people, is also replacing the need for cars when it comes to socialising. As pointed out by Time Magazine, “In the past, automobiles have represented freedom and a means to connect and socialise. Nowadays, though, people are more likely to feel connected via Facebook and smartphones.”

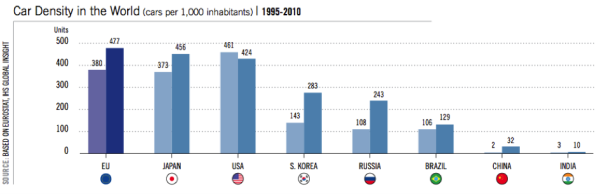

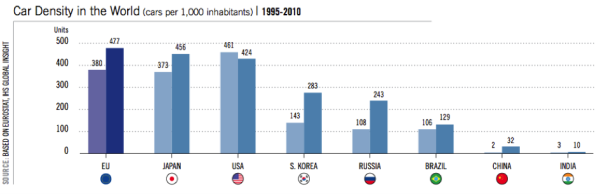

So, have we seen “peak car” in the western world? It could well be the case. Does that spell the end of the European automotive industry? Not necessarily, but even as the population grows it will be much harder to obtain growth in new car sales in Europe and the US versus the developing markets in Asia, Africa and Latin America. As shown in the European Automotive Manufacturers’ Association’s report, car density has increased a lot in emerging markets since 1995, but there is a lot of room for growth. In the US however, the number of cars per inhabitant has actually dropped and we wouldn’t be surprised if we are to see the same trend in Europe and Japan in the next 5-10 years.

To round off, a few days ago telecom giant Ericsson released a discussion paper where CEO Hans Vestberg is quoted saying ”Change will never be this slow ever again” along with a claim that we will see more technological change in the next 10 years than we have experienced during the last 100 years. Chances are that as the future enfolds, an increasing share of the population won’t require a new car to hang on for the ride.

If you want to find out how we can help you adapt your business for this changing climate, feel free to get in touch with us at Zooma.

It’s pretty clear that the automotive industry in Europe is in trouble and has been so for the last couple of years. In fact, the European auto market is set to drop this year to the lowest volume of new car sales since 1995 with a

It’s pretty clear that the automotive industry in Europe is in trouble and has been so for the last couple of years. In fact, the European auto market is set to drop this year to the lowest volume of new car sales since 1995 with a